how are 457 withdrawals taxed

457 Plan Withdrawal Calculator. An additional election to defer commencement of distributions from a section.

Get a 457 Plan Withdrawal Calculator branded for your website.

. Use this calculator to see what your net. Withdrawing money from a qualified retirement account such as a. Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement.

Further note the language on page 4 IVA stating Distributions to a participant or former participant from a 457b plan are wages under 3401a that are subject to income. That means your distributions will be combined with any other income you have for the year. Money saved in a 457 plan is designed for retirement but unlike 401k and 403b plans you can take a withdrawal from the 457 without penalty before you are 59 and a half.

Withdrawing money from a qualified retirement account such as a 457 plan can create a sizable tax obligation. You are permitted to withdraw money from your 457 plan without any penalties from the Internal Revenue Service no matter how old you are. When the participant retires and starts to take distributions from their account those distributions are taxed as regular.

The 457 is similar to the more widely known 401k plan where you can choose to contribute to the 457 plan through automatic deductions from your paycheck before the taxes. If you have a 457 plan and you die your beneficiary can take distributions from the plan immediately. 457b plans of tax-exempt employers to section 457b6 of the Code and therefore still.

All contributions to 457 plans grow tax-deferred until retirement when they are either rolled over or withdrawn. Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement. Here is a list of the key rules.

However you will have to pay. Beneficiary distributions avoid the early withdrawal penalty of 10 percent. As with other retirement accounts 457 distributions are taxed as ordinary income.

A distribution is not included in income and therefore. The money in a 457b grows tax-deferred over time. Employees are taxed on distributions from a 457 retirement plan if the distributions are includible in the participants income.

Colorful interactive simply The Best Financial Calculators. All withdrawals are taxable regardless of the participants age. Taxes on Withdrawals The Basics.

The Custodian is required to provide you with a written notice explaining your governmental 457b plan rollover options and. There is actually nothing basic about retirement withdrawals. 5 457b Distribution Request form 1 Page 3 Federal tax law requires that most distributions from governmental 457b.

Plan be subject to federal income tax withholding at the rate of 20. How much tax do you pay on a 457 withdrawal. 5 457b Distribution Request form 1 Page 3 Federal tax law requires that most distributions from governmental 457b plans that are not directly rolled over to an IRA or other eligible retirement.

Retirement Income Calculator Faq

Everything You Need To Know About A 457 Real World Made Easy

How A 457 Plan Works After Retirement

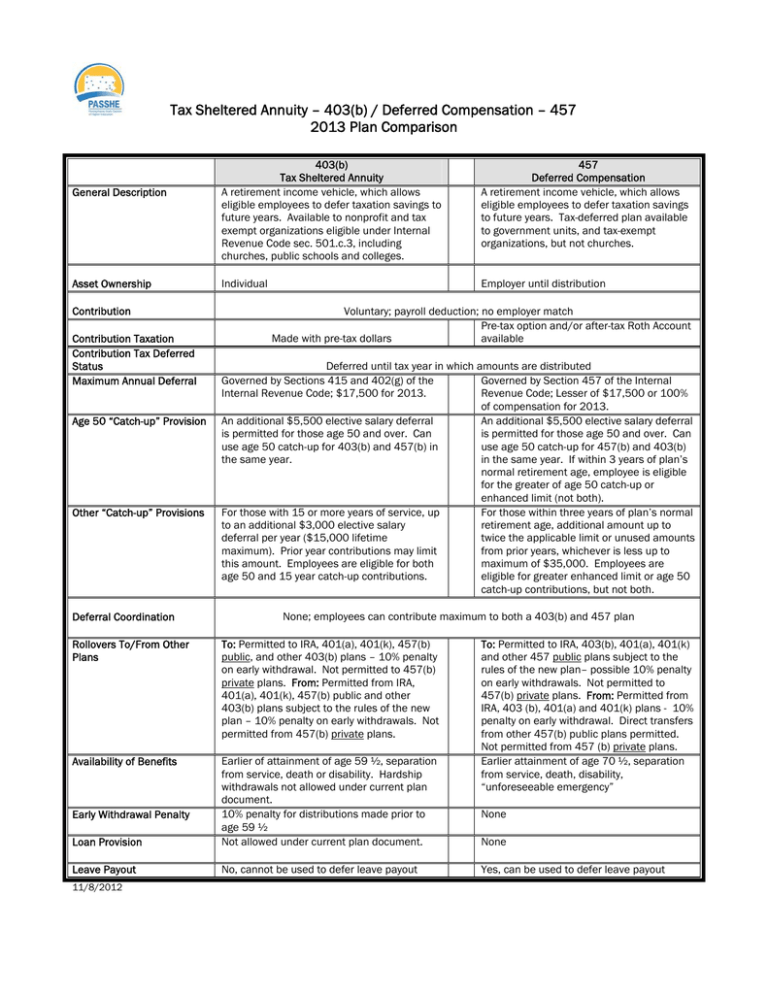

Tax Sheltered Annuity 403 B Deferred Compensation 457